Gold Overtakes US Treasuries: A Paradigm Shift in Global Reserves

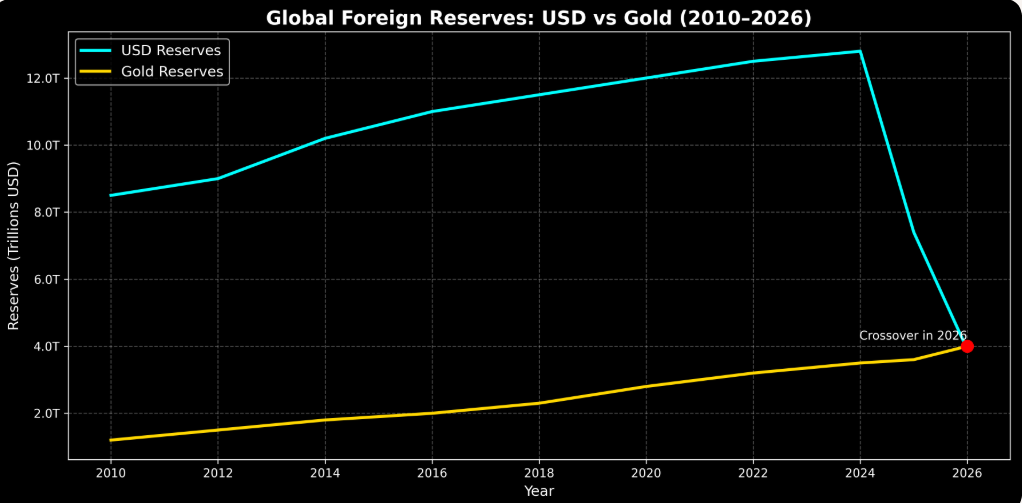

In 2026, gold overtakes US Treasuries to become the largest foreign asset held by central banks worldwide. This historic milestone signals a fundamental change in global reserves strategy, with gold holdings reaching nearly $4 trillion, surpassing U.S. Treasuries at around $3.9 trillion.

Why Gold Overtakes US Treasuries in 2026

Several factors explain why gold overtakes US Treasuries as the preferred foreign asset:

- Central Bank Diversification: Nations like China, India, and Russia accelerated gold purchases to reduce dependence on the dollar.

- Gold Price Surge: Prices soared by 70% in 2025, peaking at $4,500/oz before stabilizing at $4,200 in 2026.

- Geopolitical Risks: Rising U.S. debt, sanctions, and global conflicts pushed central banks toward gold as a safe-haven.

- Currency Hedging: Gold provided protection against dollar volatility and inflationary pressures.

Historical Context: Gold vs US Treasuries

The last time gold surpassed US Treasuries in foreign reserves was in 1996. For decades, Treasuries dominated due to the dollar’s global role. But by 2026, fiscal deficits and monetary tightening eroded confidence, allowing gold to reclaim its position as the largest foreign asset.

Global Finance Impact of Gold Overtaking US Treasuries

The rise of gold as the largest foreign asset has wide-reaching consequences:

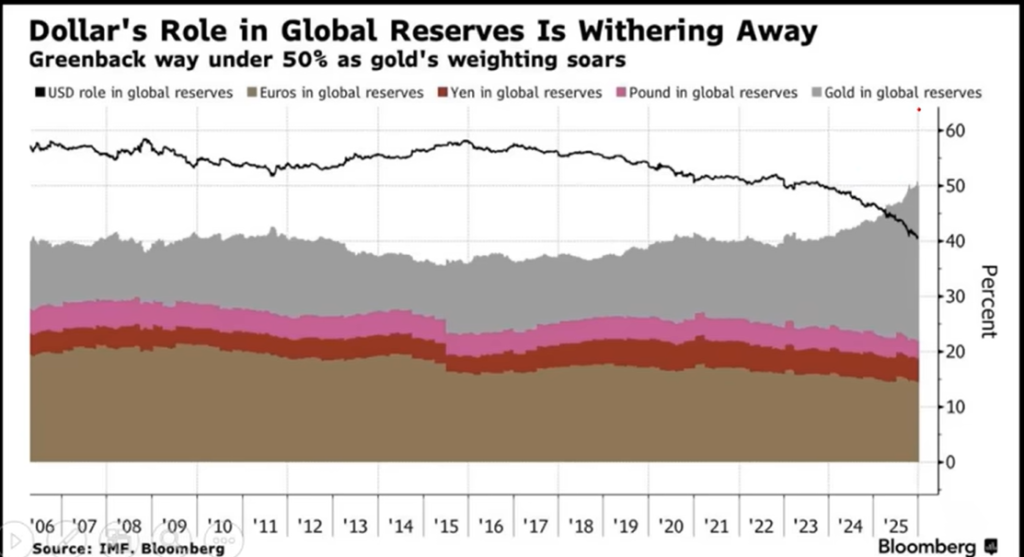

- Dollar Dominance Challenged: While the dollar remains strong, gold’s rise signals diversification in global reserves.

- Bond Market Pressure: Reduced demand for Treasuries could raise U.S. borrowing costs.

- Boost for Gold Producers: Mining nations like Australia, South Africa, and Canada benefit from sustained demand.

- Investment Strategy Shift: Sovereign wealth funds may allocate more toward commodities and alternative assets.

Comparative Analysis: Gold vs US Treasuries in 2026

| Asset | Value Held by Central Banks (2026) |

|---|---|

| Gold | ~$4 trillion |

| U.S. Treasuries | ~$3.9 trillion |

Gold Price Trend 2020–2026

The surge in gold prices explains why gold overtakes US Treasuries:

- 2020: $1,500/oz

- 2021: $1,800/oz

- 2022: $2,000/oz

- 2023: $2,300/oz

- 2024: $2,800/oz

- 2025: $4,500/oz (peak)

- 2026: $4,200/oz (stabilized)

Risks of Gold as Largest Foreign Asset

Despite gold’s dominance, challenges remain:

- Volatility: Prices fluctuate with market sentiment.

- Liquidity Issues: Treasuries offer yield and easier trading compared to gold.

- Storage Costs: Physical gold requires secure infrastructure.

Conclusion: Gold Overtakes US Treasuries in 2026

Key Takeaways

- USD Reserves: Rose steadily until 2024 (~$12.8T), then dropped sharply to ~$3.9T in 2026.

- Gold Reserves: Climbed consistently from ~$1.2T in 2010 to ~$4T in 2026.

- 2026 Crossover: Gold officially surpassed U.S. Treasuries as the largest foreign asset held by central banks.

The fact that gold overtakes US Treasuries as the largest foreign asset in 2026 marks a turning point in global finance. Central banks are diversifying reserves, reducing reliance on U.S. debt, and strengthening their positions with tangible assets. Gold’s role as a cornerstone of financial stability is now more secure than ever.

very informative.