Dollar Reels Near Four-Year Low: Market Shock

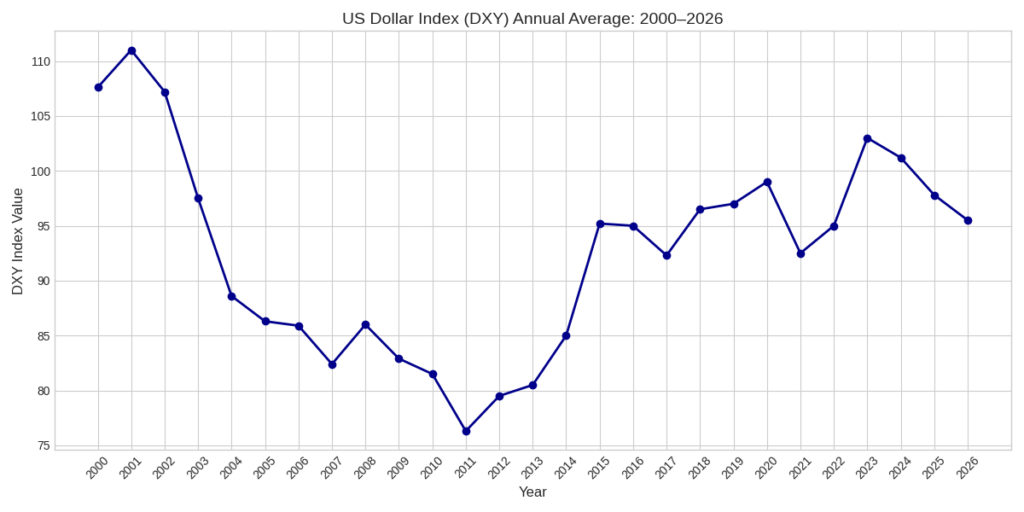

The U.S. dollar reels near four-year low after President Donald Trump brushed off worries about its slide, saying the currency was “great.” His remarks sent shockwaves through financial markets, reinforcing the perception that the administration would not intervene to stabilize the greenback. Traders responded with aggressive selling, pushing the dollar index down to 95.566, its weakest level since 2022.

This sudden drop has heightened volatility across global currency markets, with the euro, yen, and sterling all surging against the dollar. The euro briefly crossed the $1.20 mark, while sterling touched its strongest level in nearly five years.

Dollar Reels Near Four-Year Low: Global Currency Impact

- Euro: Climbed above $1.20 before settling near $1.1994.

- British Pound: Jumped 1.2% to $1.3796, its highest since 2021.

- Japanese Yen: Strengthened further, driven by safe-haven demand.

- Emerging Market Currencies: The South Korean won and Chinese yuan gained ground against the dollar.

The dollar reels near four-year low narrative has become central to global trading, as rival currencies benefit from the greenback’s weakness.

Dollar Reels Near Four-Year Low: Investor Sentiment

Investor confidence in U.S. assets has been shaken. Gold prices surged, reflecting a flight to safety. Analysts warn that the dollar’s decline is not just about economic fundamentals but also about political signals. Trump’s casual dismissal of the dollar’s weakness undermined market predictability, leaving investors uneasy.

Dollar Reels Near Four-Year Low: Economic Implications

A weaker dollar has mixed consequences for the U.S. economy:

- Export boost: American goods become cheaper abroad, supporting exporters.

- Higher import costs: Consumers and businesses face rising prices for foreign goods.

- Inflation risk: Import-driven inflation could complicate Federal Reserve policy.

While exporters may welcome the softer dollar, prolonged weakness risks eroding confidence in U.S. financial markets.

Dollar Reels Near Four-Year Low: Federal Reserve in Focus

All eyes are now on the Federal Reserve, which is set to announce its latest policy decision. Traders are watching for signals on interest rates and inflation. A hawkish stance could stabilize the dollar, while a dovish tone may deepen its losses. The Fed’s communication will be crucial in determining whether the dollar reels near four-year low continues or reverses.

Dollar Reels Near Four-Year Low: Political Dimensions

Trump’s remarks highlight the political dimension of currency markets. Traditionally, U.S. presidents avoid commenting directly on the dollar’s value. By dismissing concerns, Trump broke with convention, raising questions about the administration’s economic strategy. Some analysts suggest he views a weaker dollar as advantageous for trade negotiations, while others warn of risks to America’s financial credibility.

Dollar Reels Near Four-Year Low: Outlook

The dollar’s path ahead depends on:

- Federal Reserve policy signals on inflation and rates.

- Investor sentiment toward U.S. assets.

- Political rhetoric from the White House.

For now, the dollar reels near four-year low, reminding investors that even the world’s dominant currency is vulnerable to political shocks.

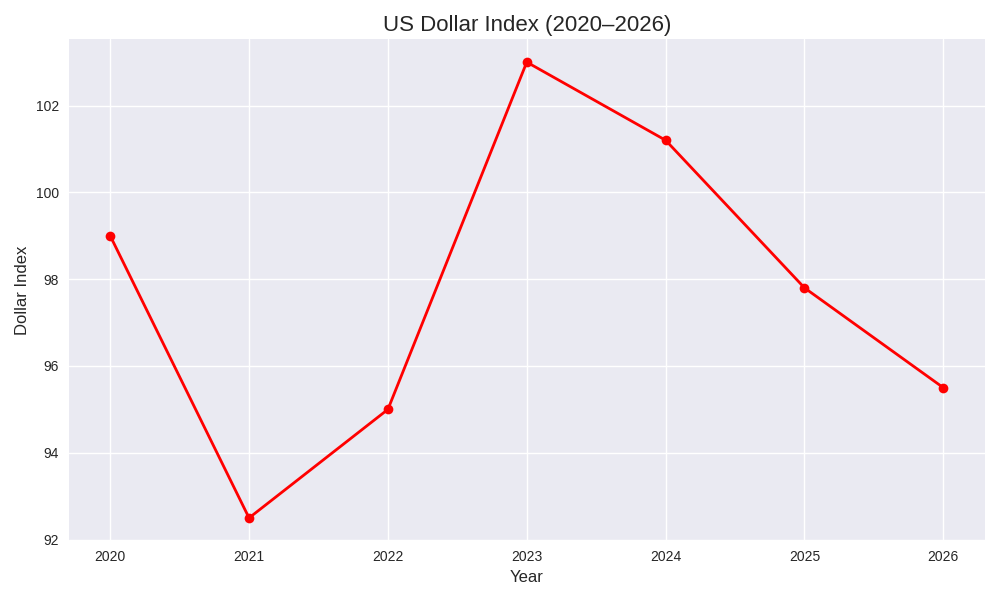

Falling Graph of U.S. Dollar Index (2020–2026)

A visual representation of the U.S. dollar index decline from 2020 to 2026 is shown in the chart above. It highlights the currency’s volatility, with peaks in 2023 followed by a steady decline toward 2026.