The Budget 2026 India: Global Agencies Applaud Infrastructure Focus and Debt Reduction has emerged as a landmark fiscal roadmap, earning commendations from leading global institutions such as Morgan Stanley and Moody’s Ratings. Presented by Finance Minister Nirmala Sitharaman, the Union Budget balances ambitious infrastructure investment with a credible plan for debt reduction, reinforcing India’s reputation as a resilient and forward-looking economy.

Budget 2026 India: Infrastructure Investment at the Core

One of the defining features of Budget 2026 India: Global Agencies Applaud Infrastructure Focus and Debt Reduction is its strong emphasis on infrastructure. The government has allocated ₹12.2 lakh crore in capital expenditure, marking a 16% increase from the previous year.

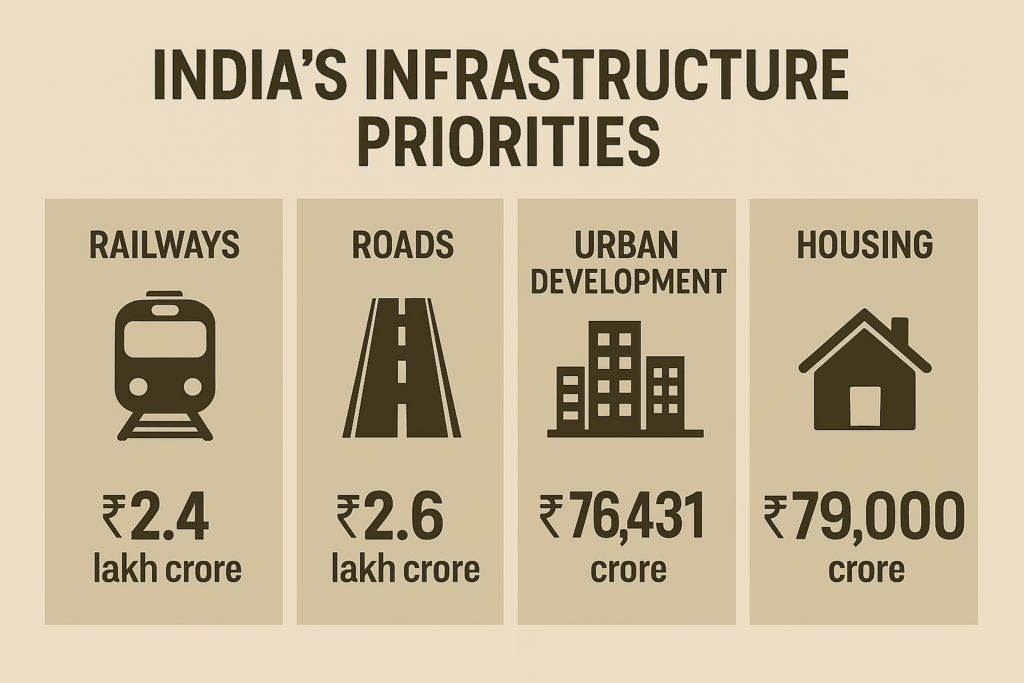

Key infrastructure priorities include:

- Expansion of railways, including Vande Bharat trains and freight corridors

- Development of expressways and rural connectivity projects

- Investment in urban infrastructure, including metro rail and smart cities

- Affordable housing initiatives to support inclusive growth

This infrastructure-led approach is designed to stimulate employment, enhance productivity, and accelerate India’s journey toward becoming a $5 trillion economy.

Budget 2026 India: Debt Reduction and Fiscal Discipline

The Budget 2026 India: Global Agencies Applaud Infrastructure Focus and Debt Reduction also underscores fiscal prudence. The government has set a fiscal deficit target of 4.3% of GDP for FY27 and projects the debt-to-GDP ratio to decline to 55.6%.

Key measures include:

- Enhanced GST collections and improved tax compliance

- Rationalized subsidies to control expenditure

- Calibrated borrowing strategy to avoid crowding out private investment

- Focus on quality spending rather than populist giveaways

This balanced approach reassures investors and rating agencies about India’s commitment to macroeconomic stability.

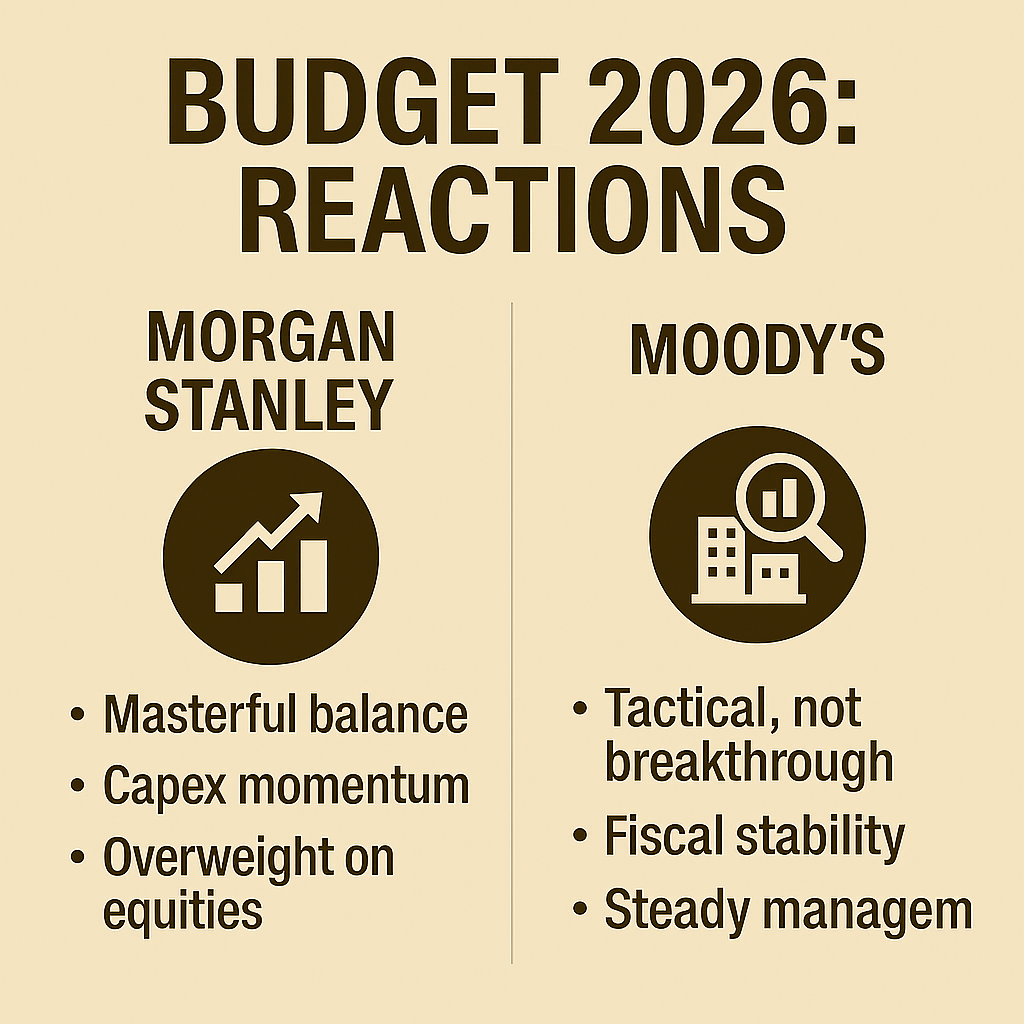

Morgan Stanley Praises Budget 2026 India

Global investment bank Morgan Stanley described the Budget 2026 India: Global Agencies Applaud Infrastructure Focus and Debt Reduction as a “masterful balance” between growth and fiscal discipline.

Highlights from Morgan Stanley’s analysis:

- Strong capital expenditure momentum expected to boost corporate earnings

- Infrastructure push to drive demand in industrials and financials

- Technology-led growth with mentions of semiconductors and AI

Morgan Stanley reaffirmed its Overweight stance on Indian equities, citing policy clarity and cyclical resilience.

Moody’s Ratings: Tactical but Stable

Moody’s Ratings acknowledged the Budget 2026 India: Global Agencies Applaud Infrastructure Focus and Debt Reduction as tactical, noting its role in maintaining fiscal stability amid global uncertainty.

Key observations:

- Fiscal consolidation supports India’s sovereign credit profile

- Borrowing strategy remains calibrated and manageable

- Growth outlook strengthened by infrastructure and manufacturing focus

Moody’s emphasized that while the budget is not transformative, it reflects a steady hand in fiscal management.

Sectoral Impact of Budget 2026 India

The Budget 2026 India: Global Agencies Applaud Infrastructure Focus and Debt Reduction is expected to benefit several sectors:

| Sector | Growth Drivers |

|---|---|

| Financials | Rising credit demand and stable interest rates |

| Industrials | Infrastructure spending and manufacturing incentives |

| Consumer Discretionary | Urban demand growth and stable tax environment |

These sectors are positioned to lead India’s next growth cycle, supported by both structural reforms and cyclical tailwinds.

Global Confidence in Budget 2026 India

The positive response from Morgan Stanley and Moody’s Ratings underscores growing global confidence in India’s economic trajectory.

- Foreign Investment: Stable fiscal policy attracts long-term capital

- Equity Markets: Constructive outlook on Indian stocks

- Policy Continuity: Signals maturity in balancing growth with discipline

India’s ability to maintain fiscal discipline while investing in future-ready sectors strengthens its position as a resilient global economy.

Conclusion

The Budget 2026 India: Global Agencies Applaud Infrastructure Focus and Debt Reduction has successfully balanced infrastructure investment with fiscal consolidation, earning praise from global agencies. With a strong focus on capital expenditure, debt reduction, and technology-led growth, the budget lays a solid foundation for sustainable expansion.

As India navigates global headwinds, this fiscal roadmap reinforces its commitment to macroeconomic stability, investment-led growth, and long-term resilience.