Bitcoin, the pioneering cryptocurrency, has experienced multiple dramatic downturns since its launch in 2009. Each crash tells a story of technological vulnerabilities, speculative bubbles, regulatory crackdowns, and macroeconomic pressures. This article explores Bitcoin crash history, analyzing the most significant collapses from 2011 to 2026.

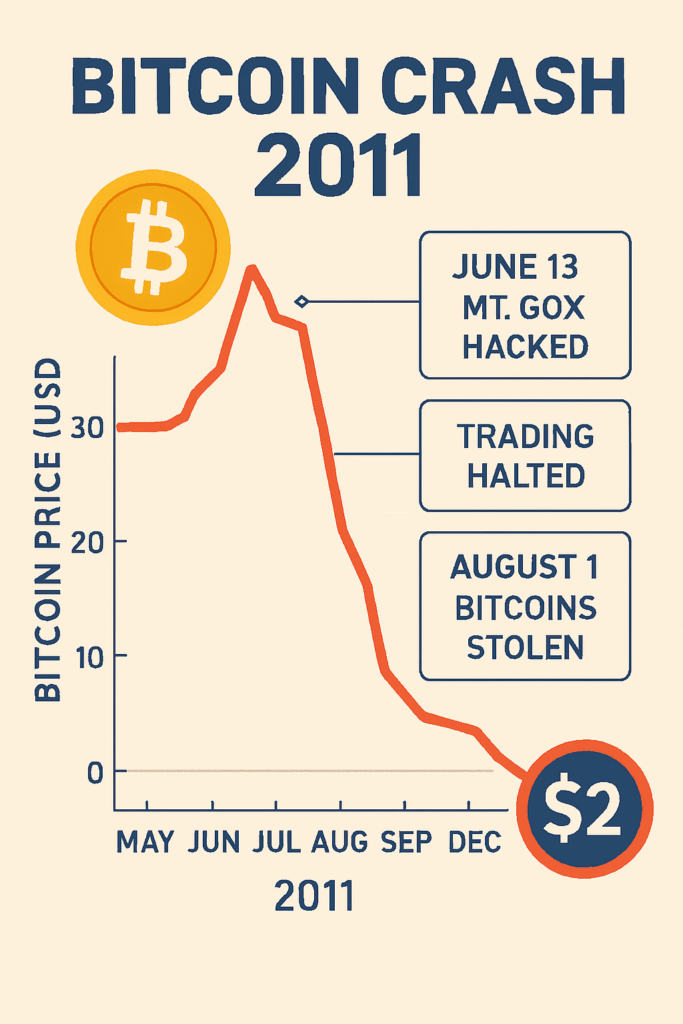

2011 Bitcoin Crash – Mt. Gox Hack and Regulatory Fears

In 2011, Bitcoin surged past $30 before plummeting to around $2. The trigger was the Mt. Gox hack, where attackers exploited weak security to manipulate trades and steal coins. As Mt. Gox was the largest exchange at the time, the incident shook investor confidence.

Simultaneously, regulatory fears emerged. Governments began scrutinizing Bitcoin’s role in anonymous transactions, linking it to money laundering and illegal activity. The lack of legal clarity discouraged institutional adoption. This early crash highlighted the risks of centralized exchanges and the urgent need for stronger cybersecurity.

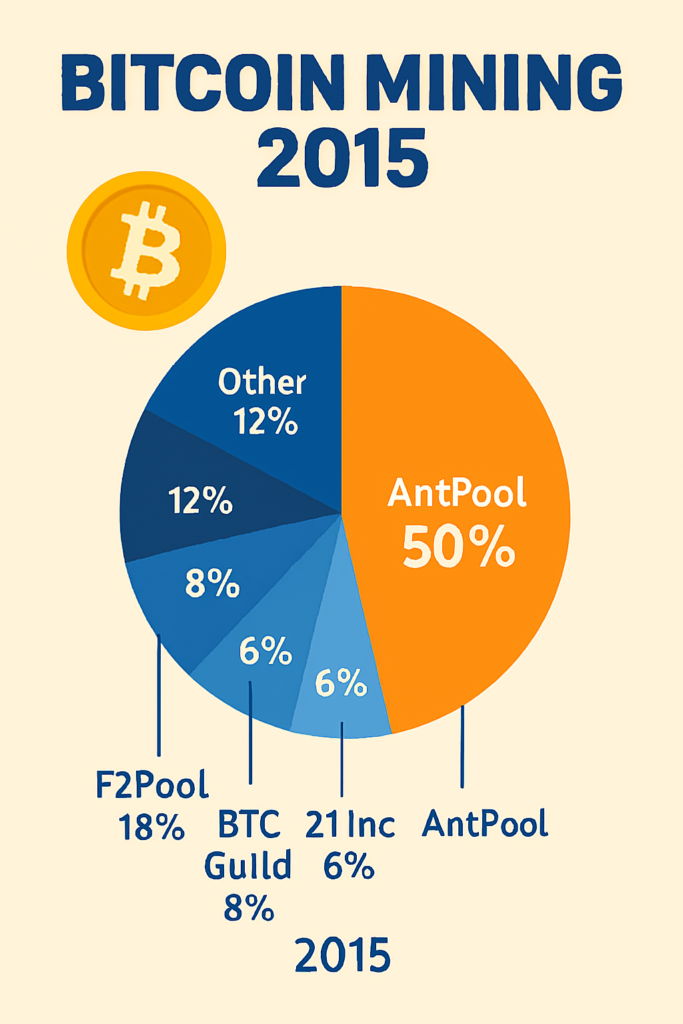

2015 Bitcoin Crash – Mining Centralization and Silk Road Fallout

By 2015, Bitcoin had matured but faced a steep decline from over $1,100 in late 2013 to below $200. Several factors contributed:

- Mining Centralization: Industrial-scale mining, especially in China, concentrated hashing power. This raised fears of a potential 51% attack, undermining Bitcoin’s decentralization ethos.

- Silk Road Fallout: The FBI’s takedown of Silk Road, a darknet marketplace heavily reliant on Bitcoin, damaged its reputation. Bitcoin became associated with illicit trade, reinforcing skepticism among regulators.

The 2015 crash underscored how external events and mining economics could destabilize the ecosystem.

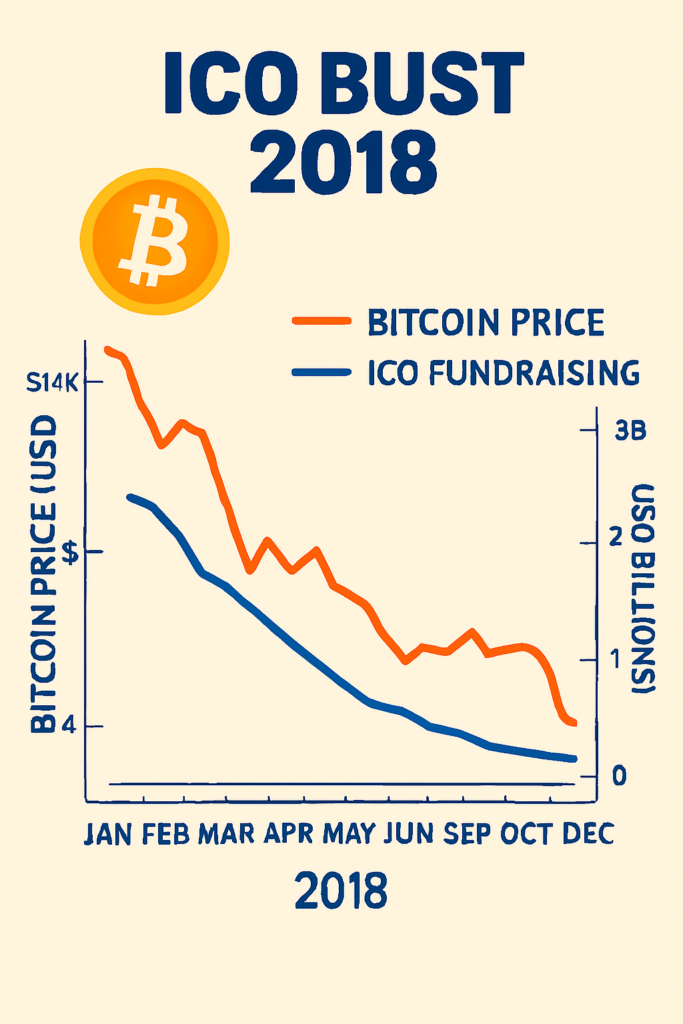

2018 Bitcoin Crash – ICO Burst, China FUD, and SEC Scrutiny

The 2017 bull run pushed Bitcoin close to $20,000, fueled by speculative mania and Initial Coin Offerings (ICOs). By 2018, the bubble burst:

- ICO Collapse: Many ICOs were fraudulent or unsustainable, leading to massive investor losses.

- China FUD: China banned domestic exchanges and ICOs, sending shockwaves across the market.

- SEC Enforcement: The U.S. Securities and Exchange Commission cracked down on ICOs as unregistered securities, chilling innovation and scaring investors.

Bitcoin plunged to around $3,000 by late 2018. This crash revealed the dangers of speculative excess and the importance of regulatory clarity.

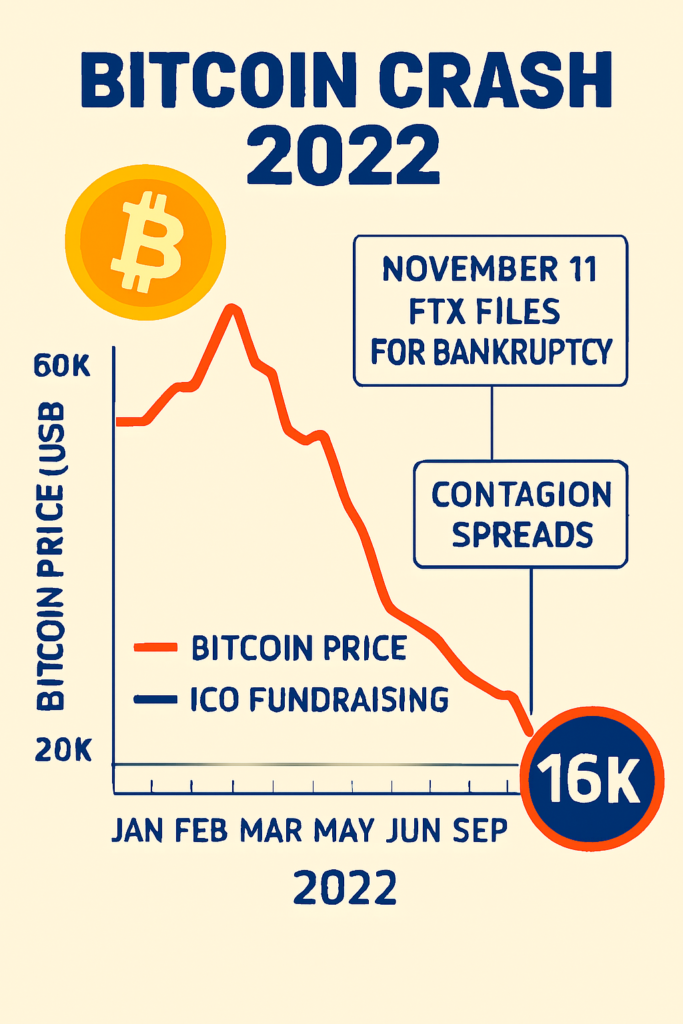

2022 Bitcoin Crash – FTX Collapse and Macro Pressure

The 2022 crash was one of the most devastating in Bitcoin crash history, with prices falling from nearly $69,000 in late 2021 to below $16,000. Two main drivers were at play:

- FTX Collapse: Once considered a reputable exchange, FTX imploded after revelations of mismanagement and misuse of customer funds. Its bankruptcy triggered contagion across the crypto industry, wiping out billions.

- Macro Pressure: Rising interest rates, inflation, and tightening monetary policy reduced liquidity. Risk assets, including Bitcoin, suffered as investors fled to safer havens.

This crash highlighted systemic risks in the crypto industry and Bitcoin’s vulnerability to global economic cycles.

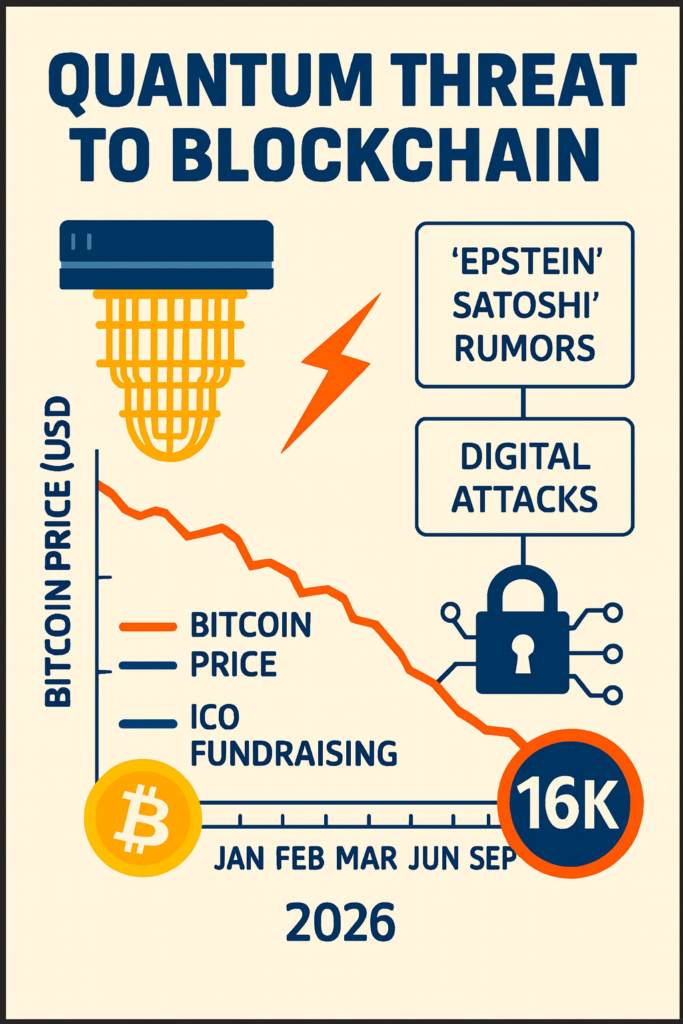

2026 Bitcoin Crash – Quantum Threats, Satoshi Rumors, and More

Looking ahead, the speculative 2026 Bitcoin crash may represent an existential crisis:

- Quantum Computing Threats: Advances in quantum computing raise concerns about Bitcoin’s cryptographic security. Even the perception of vulnerability could trigger panic selling.

- “Epstein Satoshi” Rumors: Conspiracy theories or revelations about Bitcoin’s mysterious creator could destabilize confidence. If damaging associations emerge, Bitcoin’s narrative as neutral technology may erode.

- Other Factors: Regulatory crackdowns, environmental criticisms of mining, and competition from central bank digital currencies (CBDCs) could all weigh on Bitcoin’s value.

This potential crash highlights how both technological and cultural forces could challenge Bitcoin’s resilience.

Conclusion – Lessons from Bitcoin Crash History

Across its history, Bitcoin has endured multiple crashes:

- 2011: Mt. Gox hack and regulatory fears.

- 2015: Mining centralization and Silk Road fallout.

- 2018: ICO burst, China FUD, SEC scrutiny.

- 2022: FTX collapse and macroeconomic tightening.

- 2026: Quantum threats and cultural destabilization.

Despite these collapses, Bitcoin has consistently rebounded, driven by innovation, adoption, and belief in decentralized money. Yet volatility remains intrinsic. Investors and policymakers must balance optimism about Bitcoin’s potential with caution about its risks.