RBI Stress Test Projections Highlight Banking Sector Resilience

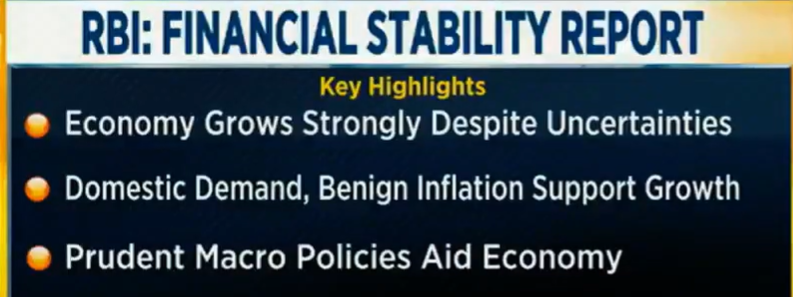

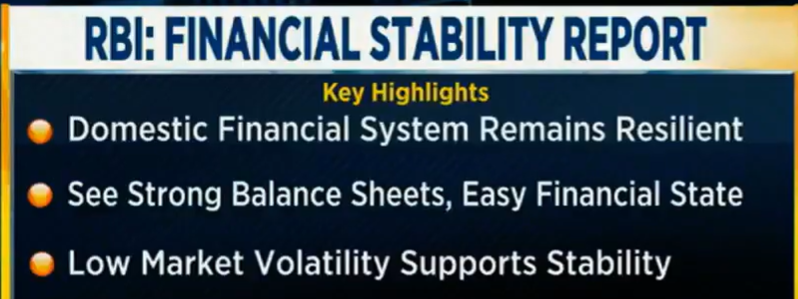

The Reserve Bank of India (RBI), in its latest Financial Stability Report (FSR) released in December 2025, presented detailed stress test projections for the country’s banking sector. The findings reaffirm the resilience of Indian banks, with the Capital to Risk‑Weighted Assets Ratio (CRAR) standing at 17.1% as of September 2025. This figure is significantly above the regulatory minimum of 9%, underscoring the sector’s ability to withstand adverse economic scenarios.

CRAR at 17.1% Reflects Strong Capital Buffers

The CRAR at 17.1% demonstrates that banks in India are well‑capitalized and capable of absorbing shocks. The RBI noted that the improvement in capital adequacy has been driven by stronger profitability, reduced non‑performing assets (NPAs), and prudent provisioning. This robust capital position provides confidence that banks can continue lending and supporting economic growth even under stress conditions.

RBI Stress Test Projections Cover Adverse Scenarios

The RBI stress test projections simulated multiple adverse scenarios, including sharp declines in GDP growth, rising inflation, and global financial volatility. Even under severe stress conditions, the CRAR of scheduled commercial banks remained well above the regulatory threshold. This indicates that the Indian banking system is resilient enough to manage risks from both domestic and global uncertainties.

RBI Stress Test Projections Show GNPA Ratio Stability

The report also highlighted trends in the Gross Non‑Performing Assets (GNPA) ratio, which has remained under control. As of September 2025, the GNPA ratio stood at 3.2%, reflecting improved asset quality across banks. Stress tests suggested that even under adverse conditions, the GNPA ratio would rise only moderately, ensuring that banks remain stable and profitable.

RBI Stress Test Projections Identify Emerging Risks

While the overall outlook is positive, the RBI stress test projections flagged certain emerging risks. Rapid growth in unsecured lending, particularly personal loans and credit card debt, could pose challenges if economic conditions deteriorate. The report also pointed to vulnerabilities in the fintech sector and crypto assets, emphasizing the need for balanced regulation to safeguard financial stability.

CRAR at 17.1% Strengthens Investor Confidence

The CRAR at 17.1% not only reassures regulators but also strengthens investor confidence in the Indian banking sector. Foreign investors and rating agencies view strong capital adequacy as a key indicator of systemic resilience. The RBI’s stress test projections provide transparency and assurance that India’s financial institutions are prepared to handle shocks.

RBI Stress Test Projections in Global Context

The RBI stress test projections also placed India’s banking sector in a global context. Compared to many advanced economies where banks face challenges from high public debt and sluggish growth, Indian banks appear better positioned. The CRAR at 17.1% is among the highest globally, reflecting the success of regulatory measures and prudent risk management.

Comparative Snapshot: RBI Stress Test Projections

| Indicator (Sept 2025) | Value | Implication |

|---|---|---|

| CRAR | 17.1% | Strong capital buffers, well above 9% minimum |

| GNPA Ratio | 3.2% | Improved asset quality, manageable under stress |

| Provision Coverage | 74% | Adequate provisioning against NPAs |

| Liquidity Coverage | Robust | Banks resilient to short‑term shocks |

RBI Stress Test Projections: Outlook for 2026

Looking ahead, the RBI stress test projections suggest that India’s banking sector will continue to remain resilient in 2026. Strong capital buffers, controlled NPAs, and healthy profitability provide a solid foundation. However, the RBI emphasized the importance of vigilance against risks from unsecured lending, fintech exposure, and global volatility.

The central bank reiterated its commitment to maintaining financial stability through proactive regulation, stress testing, and close monitoring of emerging risks.

In summary, the RBI’s stress test projections confirm that India’s banking sector remains resilient, with CRAR at 17.1% as of September 2025. Strong capital adequacy, controlled NPAs, and robust liquidity ensure that banks are well‑prepared to support economic growth while managing risks from domestic and global uncertainties.