Global financial markets are undergoing a significant transformation as Russia’s gold reserves surpass $400 billion for the first time in history. At the same time, the U.S. Dollar Index remains below 97.00, pressured by China’s call to curb treasury holdings. Meanwhile, Japan’s yen has firmed following Sanae Takaichi’s election victory, signaling renewed confidence in Tokyo’s political and economic outlook. Together, these developments highlight the shifting balance of power in global currency markets.

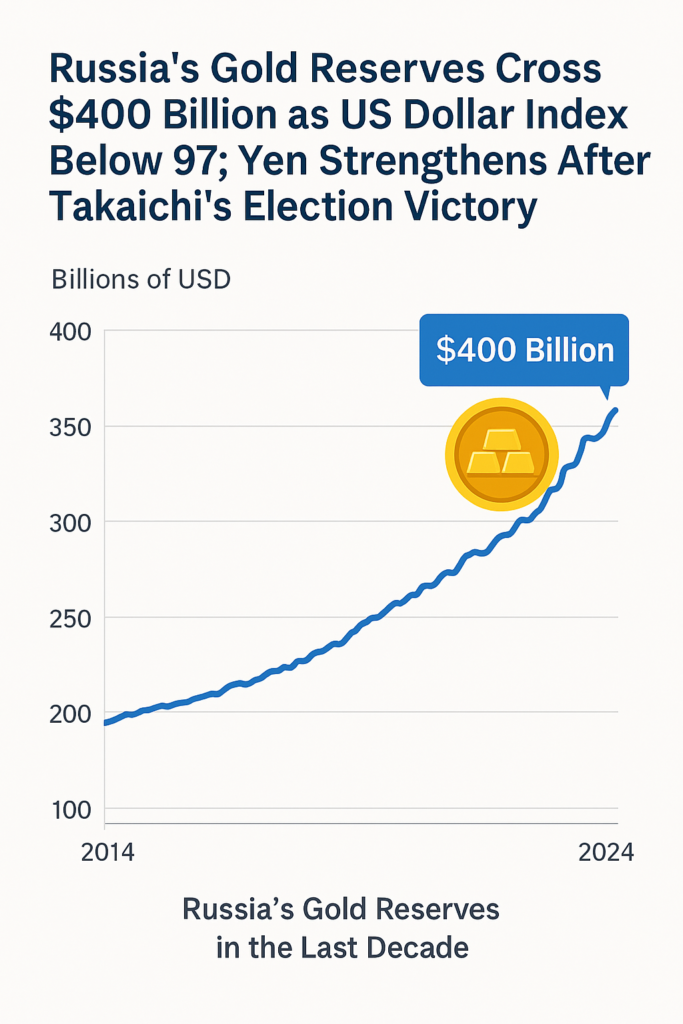

Russia’s Gold Reserves Cross $400 Billion: A Strategic Milestone

Russia’s decision to accumulate gold reserves has long been a cornerstone of its economic strategy. By crossing the $400 billion threshold, Moscow demonstrates its determination to reduce reliance on the U.S. dollar and strengthen its financial independence.

- Focus keyword: Russia’s Gold Reserves Cross $400 Billion

- Gold acts as a hedge against sanctions and currency volatility.

- Central banks worldwide are diversifying reserves, and Russia’s aggressive purchases exemplify this global trend.

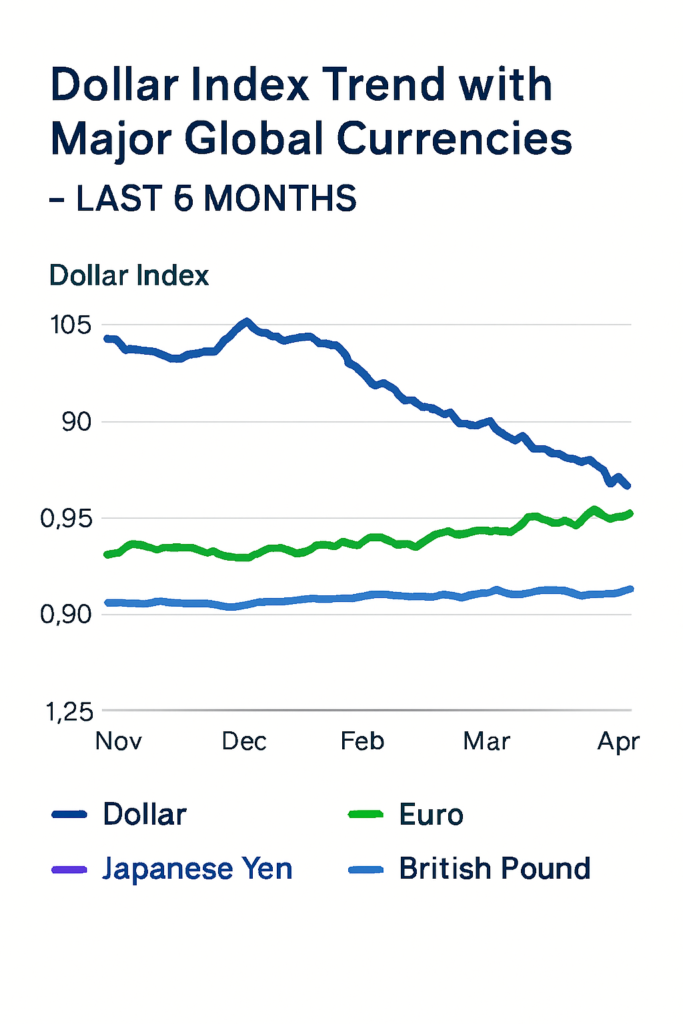

US Dollar Index Below 97: Pressure Mounts on the Greenback

The U.S. Dollar Index slipping below 97.00 reflects growing uncertainty in global markets. China’s urging to limit treasury holdings has amplified concerns about the dollar’s long‑term dominance.

- Focus keyword: US Dollar Index Below 97

- Reduced demand for treasuries could raise borrowing costs for Washington.

- Investors await a flood of economic data that may determine the dollar’s trajectory.

Yen Strengthens After Takaichi’s Election Victory

Japan’s yen has firmed following Sanae Takaichi’s election victory, underscoring investor confidence in Japan’s political stability. The yen’s appreciation reflects both domestic optimism and global demand for safe‑haven assets.

- Focus keyword: Yen Strengthens After Takaichi’s Election Victory

- Political stability often translates into stronger currency performance.

- Japan’s economic role in Asia makes yen movements critical for regional trade and investment.

Interconnected Global Currency Dynamics

These developments are deeply interconnected:

- Diversification of reserves: Russia’s gold accumulation and China’s treasury caution both signal a shift away from dollar dominance.

- Safe‑haven demand: Gold and the yen are gaining traction as investors hedge against uncertainty.

- Political influence: Takaichi’s victory highlights how leadership transitions can ripple through financial markets.

Implications for Investors and Policymakers

For investors, these shifts present both risks and opportunities:

- A weaker dollar may benefit U.S. exporters but could raise import costs.

- Gold’s surge reinforces its role as a hedge against volatility.

- A stronger yen may impact Japan’s trade competitiveness but signals stability.

Policymakers must adapt:

- The U.S. faces challenges in maintaining fiscal credibility.

- Russia’s gold strategy enhances resilience but raises sustainability questions.

- Japan’s leadership transition offers opportunities for reform and renewed investor confidence.

Looking Ahead: The Future of Global Finance

The coming weeks will be crucial as markets digest a wave of economic data. Key questions remain:

- Will the U.S. dollar rebound or continue to weaken?

- Will Russia expand its gold reserves further?

- How will Japan leverage political stability to strengthen its economy?

One certainty is that the global financial landscape is evolving rapidly. Traditional assumptions about currency dominance are being challenged, and diversification strategies are reshaping the future of international trade and investment.

Conclusion

The headline development—Russia’s Gold Reserves Cross $400 Billion as US Dollar Index Below 97; Yen Strengthens After Takaichi’s Election Victory—captures the essence of a world in transition. Gold is glittering, the dollar is wavering, and the yen is firming. For investors and policymakers alike, vigilance and adaptability will be essential in navigating this dynamic environment.